The 25-Second Trick For Hard Money Georgia

Wiki Article

Rumored Buzz on Hard Money Georgia

Table of ContentsThe Best Guide To Hard Money GeorgiaThe 10-Minute Rule for Hard Money GeorgiaThe Main Principles Of Hard Money Georgia Hard Money Georgia Fundamentals Explained

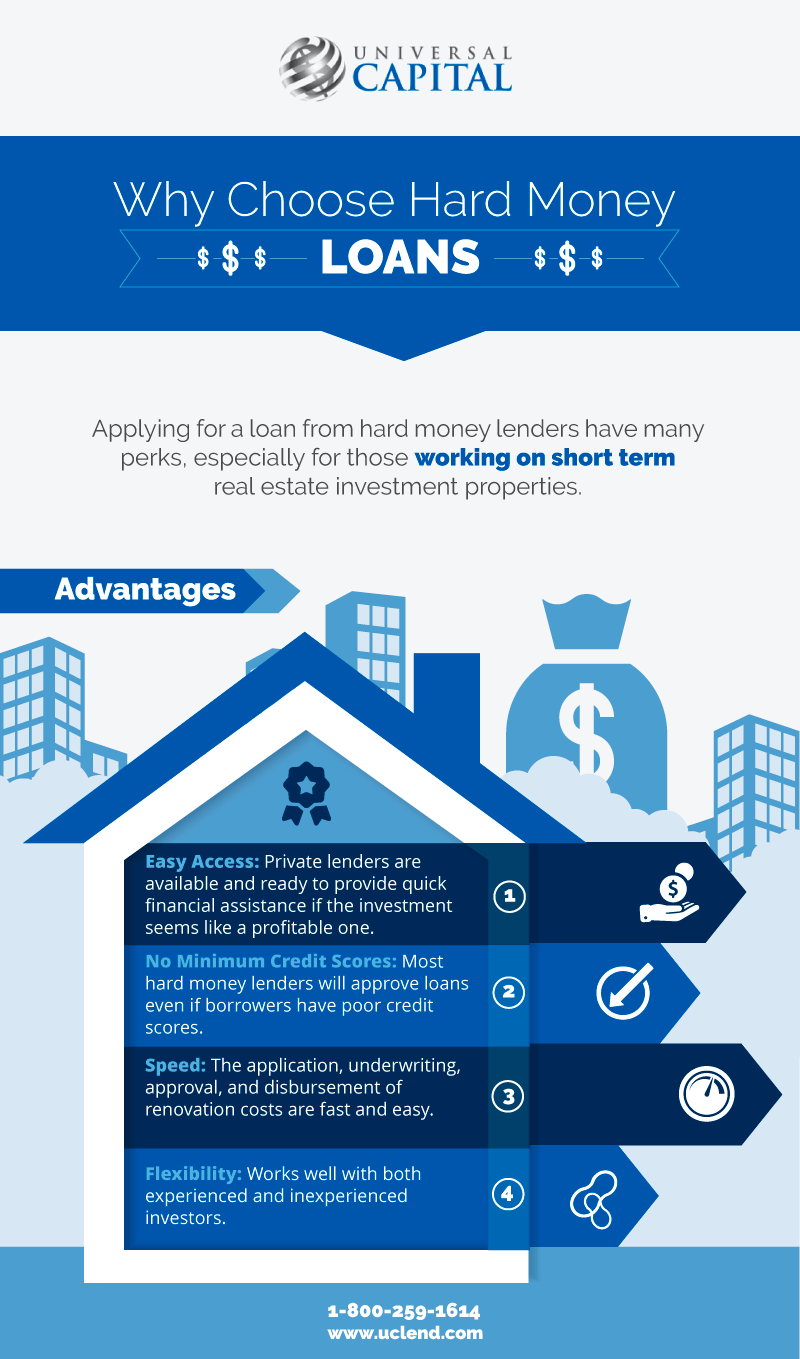

In many areas, rate of interest on hard money financings range from 10% to 15%. Additionally, a customer might require to pay 3 to 5 points, based on the overall funding amount, plus any kind of relevant evaluation, evaluation, and administrative costs. Several hard money loan providers need interest-only settlements throughout the brief period of the lending.Difficult cash loan providers make their money from the passion, factors, and costs charged to the borrower. These loan providers look to make a fast turnaround on their financial investment, thus the greater rates of interest and shorter terms of tough money loans. A difficult money loan is a great idea if a debtor needs money promptly to purchase a home that can be rehabbed and flipped, or rehabbed, rented out and re-financed in a fairly brief period of time.

They're additionally helpful for financiers that don't have a great deal of security; the residential property itself becomes the collateral for the financing. Hard money fundings, however, are not optimal for typical property owners desiring to fund a property lasting. They are an useful device in the investors toolbelt when it involves leveraging money to scale their organization - hard money georgia.

For private investors, the most effective component of obtaining a tough money lending is that it is easier than getting a typical home loan from a bank. The authorization process is typically much less extreme. Financial institutions can request for an almost endless series of documents as well as take numerous weeks to months to get a car loan authorized.

Our Hard Money Georgia Ideas

The primary purpose is to make certain the consumer has a departure technique and isn't in financial wreck. Several difficult cash loan providers will certainly work with individuals that do not have fantastic credit, as this isn't their greatest issue. One of the most essential thing hard money lending institutions will consider is the investment residential or commercial property itself.

They will certainly likewise review the customer's extent of work as well as spending plan to guarantee it's reasonable. Sometimes, they will certainly quit the procedure since they either think the home is as well much gone or the rehab budget is impractical. They will examine the BPO additional hints or appraisal as well as the sales and/or rental comps to ensure they concur with the assessment.

Yet there is another advantage constructed right into this procedure: You get a second set of eyes on your offer as well as one that is materially spent in the project's outcome at that! If a bargain is bad, you can be fairly positive that a tough money look at here now loan provider won't touch it. Nevertheless, you should never utilize that as a reason to abandon your own due diligence.

The very best area to look for hard cash lending institutions remains in the Larger, Pockets Difficult Money Loan Provider Directory Site or your regional Realty Investors Association. Remember, if they have actually done right by an additional financier, they are likely to do right by you.

The Buzz on Hard Money Georgia

Read on as we review hard money loans and why they are such an appealing alternative for fix-and-flip real estate financiers. One significant benefit of difficult cash for a fix-and-flip investor is leveraging a trusted lending institution's dependable funding and also rate.You can take on jobs incrementally with these critical car loans that enable you to rehab with simply 10 - 30% down (relying on the lender). Hard cash loans are usually temporary loans used by genuine estate financiers to money fix and also flip buildings or various other property investment deals. The property itself is utilized as collateral for the lending, and the high quality of the realty deal is, consequently, a lot more crucial than the debtor's credit reliability when getting the funding.

This also means that the risk is look at here now greater on these financings, so the passion rates are generally greater as well. Repair and turn financiers choose tough cash since the market does not wait. When the chance emerges, and you prepare to get your task right into the rehab stage, a difficult money financing obtains you the money straightaway, pending a fair evaluation of the business bargain. hard money georgia.

Ultimately, your terms will depend on the difficult cash lending institution you pick to work with and your distinct scenarios. The majority of hard money loan providers operate in your area or only in specific areas.

Not known Factual Statements About Hard Money Georgia

Intent as well as building documents includes your thorough extent of job (SOW) as well as insurance coverage. To evaluate the home, your loan provider will take a look at the value of equivalent properties in the location as well as their forecasts for growth. Adhering to a quote of the residential property's ARV, they will fund an agreed-upon percent of that value - hard money georgia.This is where your Scope of Job (SOW) enters play. Your SOW is a file that information the work you intend to perform at the building as well as is generally required by a lot of hard cash loan providers. It consists of remodelling costs, duties of the celebrations involved, as well as, frequently, a timeline of the deliverables.

Let's presume that your residential or commercial property does not have a completed cellar, but you are preparing to complete it per your range of job. Your ARV will certainly be based on the marketed prices of similar residences with finished cellars. Those prices are likely to be more than those of homes without ended up cellars, thus boosting your ARV and potentially certifying you for a greater lending quantity.

Report this wiki page